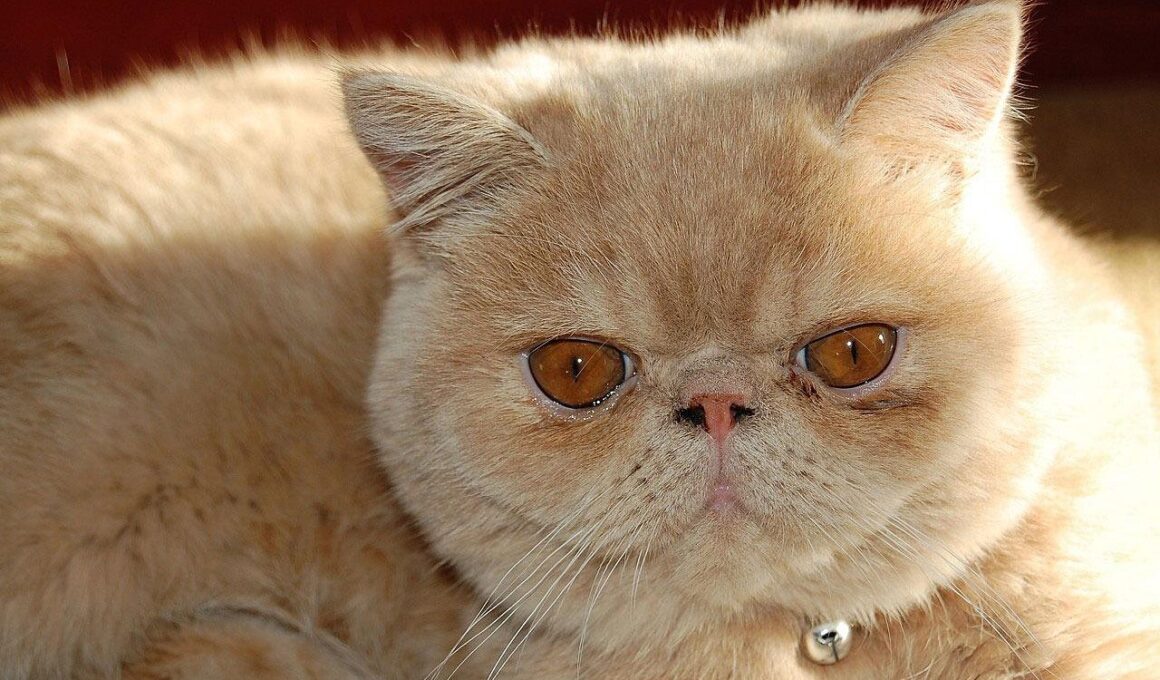

Exotic Cat Insurance: What’s Covered and What’s Not

When considering cat insurance for exotic breeds, it’s crucial to understand the specific coverage options available. Exotic cats, such as Savannahs or Bengals, often require specialized medical care due to their unique breeds. Standard policies might not fully cover potential health issues specific to these cats. Typical exclusions often involve hereditary conditions prevalent in exotic breeds. Therefore, reviewing insurance plans, particularly those tailored for exotic cats, can help in ensuring comprehensive coverage. Moreover, always compare multiple providers. Start with understanding how a policy defines coverage, as some companies may include preventative care while others do not. Additionally, check for waiting periods for pre-existing conditions. Certain health problems can manifest early; thus, ensuring coverage as soon as you adopt an exotic breed is crucial. Furthermore, speak to veterinarians about specific health concerns your exotic cat might face. Lastly, factors like age and previous health history of your cat can significantly affect your premium costs. Choosing the right policy for your exotic feline can not only provide peace of mind but also protect your financial investment in your pet’s health.

Understanding the essential components of exotic cat insurance policies can guide pet owners towards a suitable option. Coverage generally includes veterinary visits, treatments, bot medications, emergencies, and surgeries. It is vital to check the limits on specific treatments, as some breeds might be more prone to particular medical conditions. In addition to routine care, assessing catastrophic incidents such as accidents and critical illnesses is equally important. Make sure to evaluate the lifetime coverage limits to be aware of how much you might pay out-of-pocket over the lifetime of your exotic cat. Exotic breeds may require special treatments as they age or develop chronic conditions. This also applies to diagnostic tests, which could be more expensive for exotic breeds. Always consider the deductible, copayment amounts, and coverage percentages offered within the plan. Reading through the fine print can provide insights on what is excluded. Lastly, consult with insurance agents who specialize in exotic pets for personalized advice tailored to your specific situation. They can assist in navigating through the various options, ensuring you arrive at an informed decision regarding your exotic cat’s health insurance.

Common Exclusions in Exotic Cat Policies

Despite comprehensive coverage options, exotic cat insurance typically includes certain exclusions that owners should be aware of. Pre-existing conditions are often a major exclusion in cat insurance. If your cat has been diagnosed with a respiratory issue or heart problem, most insurers will not cover related expenses. Furthermore, cosmetic procedures or treatments aimed at enhancing an exotic cat’s appearance fall outside standard coverage too. Also, treatments resulting from negligence or failure to provide regular care are often excluded, making preventive veterinary visits exceptionally crucial. Many policies also mention breed-specific exclusions; hence, it’s essential to be familiar with your cat’s breed traits. Always check the fine print regarding behavioral treatments, as many policies limit coverage for modifications related to anxiety or excessive aggression. Lastly, certain exotic breeds may not be insurable due to specific risks associated with their health or temperament. In some instances, if a breed is deemed too high-risk, the insurer might refuse coverage altogether. It’s exponentially beneficial to closely analyze the policy terms before committing.

Aside from standard exclusions, certain conditions may not be covered under any policy, regardless of breed. For instance, congenital issues not identifiable at the onset often fall into this category. Most insurance providers are keen on avoiding covering anything deemed hereditary or genetic that manifests later in life. Cat owners must be aware of behavioral issues that arise, as these usually lack coverage in most policies. Routine vaccinations are typically excluded as well, which adds to costs over time if they become due annually. Additionally, alternative treatments such as acupuncture or chiropractic sessions might not fall under some policies. It’s paramount to share your exotic cat’s complete medical history when applying for insurance to avoid misunderstandings. Thus, thorough research and understanding are vital before signing an insurance agreement. Expect to receive quotes based on your pet’s age, breed, and prior health issues. Many policies are adapted to suit exotic breeds, which means tailoring your choice according to your unique feline’s needs can yield considerable benefits in the long run.

How to Select the Right Policy

Selecting the right exotic cat insurance policy requires careful consideration of various factors. Firstly, start by assessing your budget and the level of coverage you can afford. Analyze how much you’re willing to spend monthly versus what you are comfortable with in case of an emergency. Look into companies that explicitly specialize in exotic pet insurance, as they often offer bespoke solutions tailored for such unique breeds. In addition, reading customer reviews can help in understanding how well different insurers handle claims. Its always wise to check their customer support mechanism as timely help can be a decisive factor in emergencies. Once you shortlist potential insurers, request detailed quotes, and compare them side by side. This will aid in recognizing differences in premiums, deductibles, and coverage limits, leading to a more informed selection. Keep in mind, policies with lower monthly payments might come with higher deductibles. Provide accurate information about your exotic cat’s breed and conditions to avoid claims being denied during emergencies. It can be useful to inquire about additional discounts available for multi-pet households.

One critical aspect during the selection process is understanding the waiting periods involved before full coverage kicks in. Waiting periods are times when no claims can be made following the purchase of a policy. They vary significantly from one insurance company to another. Some insurers impose extended delays for major medical claims that might deter immediate coverage. Understanding the waiting periods is vital, particularly if your exotic cat has an ongoing health concern. Speak with your vet about the expected time, costs, and accessibility of treatments. Additionally, tap into online forums and communities specifically for exotic breed owners. Engaging with fellow cat enthusiasts can provide firsthand experiences of insurance claims processes, helping to demystify your decision. They may also offer tips on how to best approach specific insurers based on your need. Lastly, having a solid support system in place makes the process smoother and may even save you money in the long run by identifying more suitable insurance options. Taking the time to ask questions, researching, and building connections is invaluable for pet owners.

The Importance of Regular Vet Visits

To minimize risks that come with owning exotic cat breeds, regular veterinary visits are indispensable. Such visits can be instrumental in identifying potential health issues before they escalate, providing an overall healthier life for your cat. During these appointments, be sure to discuss your insurance coverage with your vet, ensuring they provide care compliant with your policy. Additionally, maintaining a record of all vet visits might help in presenting claims. Consistent monitoring can also lower the chances of exclusions relating to chronic illnesses over time. Data gathered during these visits can play a crucial role in justifying claims if health issues arise later. Consider vaccinations and routine exams as part of preventative measures that can be significantly beneficial in the long run. Regular vet visits may yield a history of health concerns that are crucial for making informed decisions about your exotic cat’s insurance policy. Being proactive about your exotic cat’s health not only fosters a better life for your feline but can also lead to lower insurance premiums as age-related risks are reduced.

Finally, one of the most vital aspects of ensuring you have the best cat insurance policy for your exotic breed lies in staying informed. Keep abreast of any changes in coverage terms or premium adjustments. Insurers often update policies, and being aware of those changes helps in making timely decisions. Attending informational sessions or webinars focusing on exotic pet insurance can provide insights into emerging health concerns affecting your breed. Additionally, being part of pet owner groups, both online and offline, allows sharing of information and forming supportive networks. This way, you can exchange experiences, insights about vets, and discover which insurance policies other owners favor for their exotic cats. Furthermore, connecting with feline behaviorists can add another layer of understanding about the unique needs of exotic cats. Overall, staying informed not only benefits you as a pet owner but tremendously enhances the well-being of your exotic cat. By employing a proactive approach, prioritizing your cat’s health, and understanding insurance, you can enjoy a rich and fulfilling experience with your exotic feline companion.